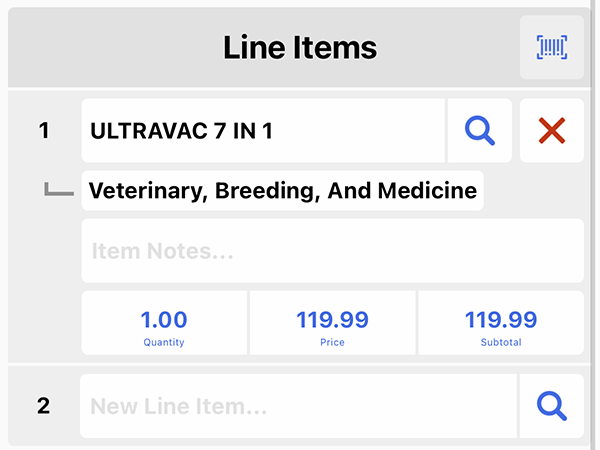

Transaction ItemsTransaction items are optional, however once you include items the transaction totals will be calculated as the sum of items.

Description: is the line items product name. Transaction items can either link to products or created as free text.

Revenue / Expense Account: categorizes the line item for accounting purposes.

Item Notes: is additional notes about the line item.

Quantity: is the unit count for the line item.

Price: default value is picked up from the

product settings (transaction type expense will use 'Cost', transaction type

revenue will use 'Price'), however can be overridden.

Subtotal: is calculated as (quantity x price)